Our team was recently drafting an email campaign for the amazing Bloom Money, and their Co-Founder Jamie shared a client case study for us to use which stopped us in our tracks.

In this email campaign, we shared the story of how Bloom Money secured one of their 1:1 session clients a $34,000 GST refund, after discovering they had been previously paying GST on their Facebook ad spend and not getting it credited back to them.

As soon as we heard this story from Jamie, we knew we had to share it with you all, because this has to be happening to a lot of business owners out there and no one is talking about it!

So, we sat down on an Instagram Live with the amazing Jamie (who joined us all the way from Bali!) and combined our marketing brains and her accounting know-how to help you spend less and make more with Meta Ads.

Meet Jamie from Bloom Money

Jaimie has 10 years experience up her sleeve as a Finance Business Partner and Management Accountant in the corporate world for a whole range of industries from Hotels to pharmaceuticals, throughout Australia, USA and Europe.

Before you ask, yes, she is the type who spreadsheets every detail of every holiday for fun and has a list for everything. Any spare time you will find her hanging out with the little fam or listening to (nerdy) podcasts like ‘How I Built This’ and ‘Business Wars’.

Bloom Money is her 5th business launch to date (if you count a ‘dog walking’ side hustle from uni).

Meet Hayley & Katy from Oh My Digital

Katy and Hayley Co-Founded Oh My Digital in 2017 to bring honesty, loyalty, empowerment (and fun) to the digital marketing industry. We are your female-led Brisbane digital marketing agency, supporting brands who want to make an impact on their industry, because that’s exactly why we started.

Our expert dream team will support you to achieve long-term growth with a sustainable strategy that drives consistent results without the hacks or hustling. We specialise in full-funnel digital marketing that turns your secret admirers into obsessed repeat buyers.

Watch the Instagram Live Replay: How to Spend Less & Make More with Meta Ads, featuring Bloom Money and Oh My Digital

Affiliate Disclosure: This blog post contains affiliate links. If you make a purchase with Bloom Money using our affiliate link, we’ll receive a small commission for sending you their way. You can trust that this recommendation comes with the OMD seal of approval. It is your personal responsibility to evaluate whether any affiliate offer, including any products or services with Bloom Money, is right for you or your business. As always, we encourage you to do your own research and due diligence before making any purchase decision.

Make sure you’re claiming GST credits on your ad spend

Bloom Money secured one of their clients a $34,000 GST refund, after discovering they had been unnecessarily paying GST on their Facebook ad spend. This client has been working with another bookkeeper, and booked a 1:1 Successful Startup session with Bloom Money.

When Jamie’s team reviewed this client’s expenses for the 1:1 session, they found that their Facebook ad spend was being incorrectly categorised as GST-free. This meant they were paying GST on their ad spend, and not getting it credited back to them.

Need a deep-dive into your business finances to set your empire up for success? Book your own Successful Startup session with Jamie here.

The lesson? Never assume your bookkeeper knows which of your expenses include GST or not. They may make an assumption, and it may be wrong! So, if you’re a business registered for GST and spending heavily (or at all, really) on ads, ensure your Australian Business Number (ABN) is entered in your Facebook settings. Here’s how to do it!

How to add your Australian Business Number (ABN) to your Meta Ad Account in 2024

Find Meta’s official instructions here, or follow our visual guide below (last updated 6 November 2024)

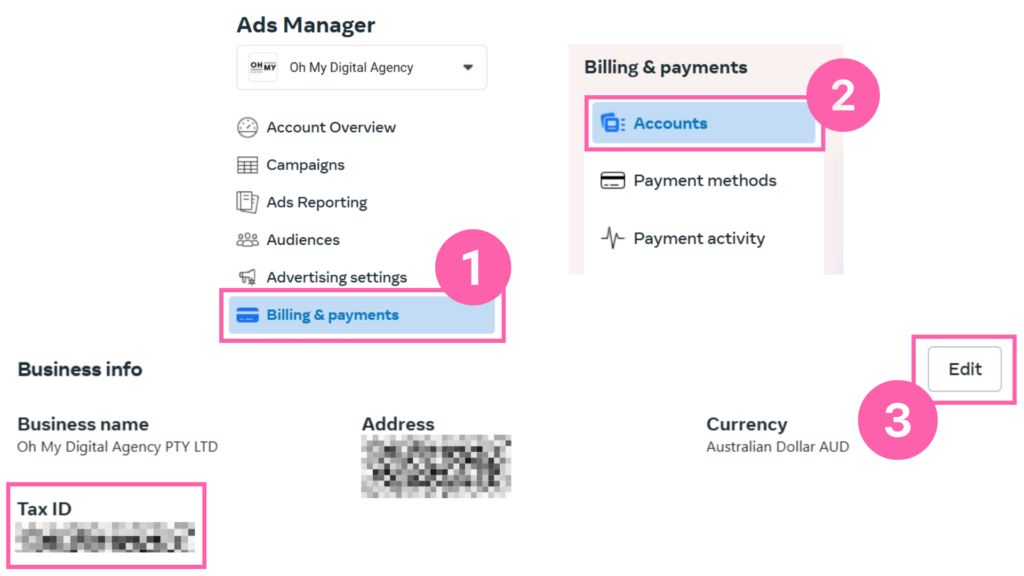

- Open Meta Ads Manager

- Click ‘Billings & Payments‘ from the left-hand-side menu

- Click ‘Accounts’ under ‘Billing & Payments’, then select your ad account from the list that appears by clicking on the ad account name.

- Scroll to the bottom of the page to the ‘Business Info’ section. If your ABN is not already shown here, click ‘Edit’ and fill out your business details, then save. Done!

Use the Billing Threshold and Account Spending Limit to help with Cash Flow and Ad Delivery

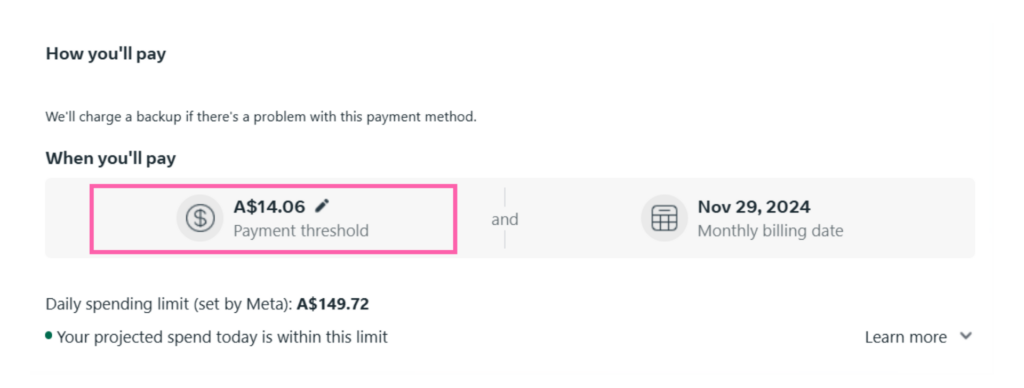

Your billing threshold controls how frequently Facebook bills your ad account payment method. If Facebook invoices you in small increments, raising your billing threshold can simplify your accounting by reducing the number of separate transactions and receipts you incur. However, if your threshold is set too high, unexpected charges can disrupt your cash flow.

We recently noticed something very alarming in one of our client’s ad accounts. Previously her billing threshold was set to around $3000, similar to her monthly ad spend, however, Meta later updated this to $19,000, without any notice or consent! This is great if your ad account is spending this amount or more each month, but if not? You could easily miss that you weren’t being charged for your ads, and end up with a big bill in a few months’ time! This could result in your ads pausing due to a failed payment, or even cash flow issues in your business if you haven’t set that advertising spend aside.

Here’s how to check your billing threshold to take back control of your spending on Meta.

How to check and update your Meta ad account billing threshold in 2024

- Open Meta Ads Manager

- Click ‘Billings & Payments‘ from the left-hand-side menu

- Click ‘Accounts’ under ‘Billing & Payments’, then select your ad account from the list that appears by clicking on the ad account name.

- Scroll to the ‘When you’ll pay’ section, and click the pencil icon to edit your payment threshold.

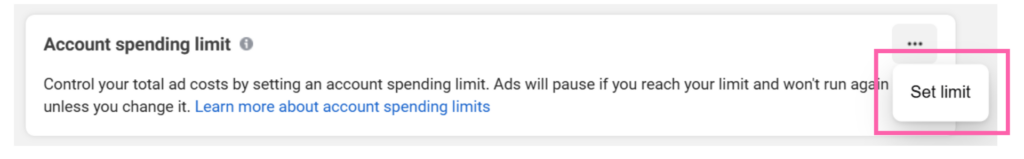

Unlike your billing threshold which controls when you get charged, an account spending limit can be set to control how much your ad account can spend at a time. Setting a payment cap is useful for budget control, but can cause your ads to stop running if the limit is hit and you don’t realise.

We often see clients set an account spending limit and then forget about it, which can cause their ads to randomly stop running down the track even though they intentionally want to spend more. Luckily for our clients, we will notice and fix this up for them, but be careful if you are managing your own ads. If your ads turn off due to hitting your spending limit and you don’t correct it immediately, you’re going to miss out on sales. This is not what we want, especially in Q4 when the ad space is already so competitive!

How to set an account spending limit for Meta ads in 2024

- Open Meta Ads Manager

- Click ‘Billings & Payments‘ from the left-hand-side menu

- Click ‘Accounts’ under ‘Billing & Payments’, then select your ad account from the list that appears by clicking on the ad account name.

- Scroll to ‘Account spending limit’ section. From here, you can edit your existing limit, or click on ‘set limit’ if you would like to do this from scratch. You can then set a maximum amount you would like to spend each month, or until you turn it off.

Don’t Forget about your Existing Customers in your Ads Targeting

So many brands forget to market to their existing customers because of the mindset ‘they will buy anyway’, but this is WRONG.

A great product and excellent customer service is the bare minimum that consumers expect. That alone is not enough to keep them coming back again and again.

If you ignore your existing customers;

They will forget to re-order,

They will not feel valued, and

They will get distracted by your competitors who ARE talking to them

The solution? A good marketing strategy drives revenue from new and existing customers.

Without prioritising both, you will face problems like…

❌ Your customer acquisition costs are too high.

❌ Your marketing costs are more than 30% of your revenue

❌ You get lots of social media engagement or traffic but it doesn’t translate to sales

❌ Your customers seem happy but aren’t repurchasing or leaving reviews

❌ Your competitors are stealing your customers

Let’s look at some ways you can avoid this in your Facebook ads strategy, and get better returns on your ad spend.

For service-based businesses

- Target past customers who haven’t rebooked with you in a while and offer an incentive to reward them and encourage them to come back.

- Use a Meta lead generation campaign to build your email list by offering a high-value resource to potential clients. This works well for professional-services, or any businesses with a longer sales cycle that needs to build trust, or help a problem-aware audience become solution-aware.

For eCommerce businesses

- Target your existing social media engagers and website visitors in Engagement campaigns. This will encourage your most passionate customers to comment and share their experiences on your ads, which is invaluable social proof to encourage more purchases from new customers!

- Use catalog ads to run cross-sell and up-sell campaigns to shoppers who purchased relevant items within a set window of time. Think about the typical purchase frequency of your customers and use this to get that next sale sooner, or ensure it goes to you instead of a competitor.

Love being your own boss but not sure where to start when it comes to the numbers?

If this is an area where you know you need some support, book your 1:1 “Successful Startup” session with Jamie, and she’ll spend two hours with you to:

- Explore the Intent of your business

- Translate that into measurable financial goals for 2023/2024

- Create the budget you get to take away, keep and keep yourself accountable to

- Discuss how to monitor and use your budget each month

- Plus your long list of questions and training required

General Advice Disclaimer: This article is for general information purposes only and should be used solely as general guidance. It does not and is not intended to represent financial advice or other professional advice.